A Shifting Landscape in Luxury Investment

For decades, diamonds have been promoted as a timeless store of value—“forever” in both romance and economics. Traditionally, this meant mined diamonds, whose rarity and cultural significance kept demand steady. However, shifts in technology, consumer values, and global trade are creating a new category in ethical investing: lab-grown diamonds.

At EcoFacets, we’ve seen a dramatic change in buyer behavior over the past five years. More consumers—and increasingly, investors—are looking at sustainability, transparency, and flexibility as key factors in their purchasing decisions. These priorities are transforming lab-grown diamonds from a niche product into a viable, future-proof asset class.

The Diamond Market: Old Model vs. New Reality

The traditional diamond market has relied on perceived scarcity, controlled supply chains, and brand-driven demand. While this model created the allure of exclusivity, it also came with:

- Price opacity that made it difficult for consumers to determine true value.

- High entry costs, limiting market participation.

- Volatile resale values, especially for non-rare stones.

Lab-grown diamonds disrupt this by introducing:

- Transparent pricing anchored in production costs rather than artificial scarcity.

- Accessibility, allowing more buyers to invest without inflated premiums.

- Ethical and environmental assurances, aligning with ESG (Environmental, Social, Governance) investment trends.

Why Lab-Grown Diamonds Appeal to Investors

1. Lower Entry Cost, Comparable Beauty

Lab-grown diamonds cost 30–50% less than equivalent mined diamonds, making them more accessible for first-time investors and enabling portfolio diversification.

2. Predictable Quality

With advanced growth methods like Chemical Vapor Deposition (CVD), investors can source diamonds with consistent quality grades, ensuring easier valuation and resale planning.

3. The Sustainability Premium

ESG-conscious consumers are willing to pay a premium for products with low carbon footprints and transparent sourcing. This is fueling demand for ethical luxury products, including lab-grown diamonds.

4. Institutional Interest

The jewellery trade, fashion houses, and even industrial sectors (where diamonds are used for cutting tools and technology) are beginning to integrate lab-grown stones, signaling a broader market adoption.

EcoFacets’ Investor-Friendly Policies

Our 80% Buyback and 100% Exchange Promise is a built-in safety net for both retail customers and investors. Unlike traditional markets, where selling requires finding a willing buyer, our clients can return their diamonds directly to EcoFacets for guaranteed value recovery.

We also offer:

- Portfolio Consultation Services to guide diamond selection based on investment goals.

- Liquidity Planning for clients who wish to use their diamond assets as part of broader financial strategies.

- Refurbishment & Resale Programs that extend the lifecycle of each diamond, aligning with sustainability goals.

The ESG Angle: Investing with Impact

The environmental and social governance aspect of lab-grown diamonds can’t be overstated. Investors are increasingly expected to align portfolios with climate goals, ethical labor practices, and resource conservation.

Lab-grown diamonds:

- Use 85% less water and significantly less energy than mined diamonds.

- Produce minimal CO₂ emissions, especially when made with renewable energy.

- Eliminate risks of human rights violations tied to mining in conflict zones.

These factors position lab-grown diamonds as tangible ESG assets—products that are both beautiful and beneficial for the planet.

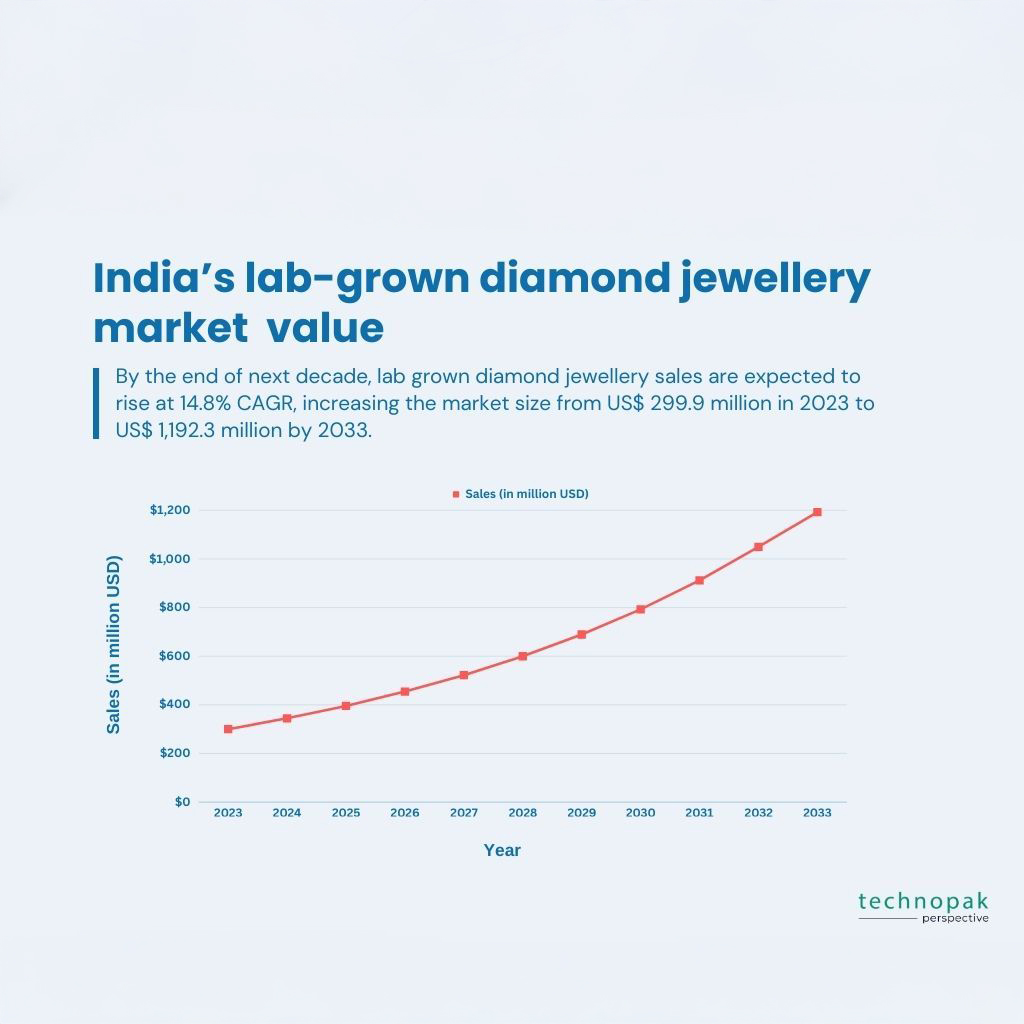

Market Outlook: The Next Decade

Industry analysts forecast that lab-grown diamonds could account for 20–30% of the global diamond market by 2030, up from roughly 8–10% today. This growth will be driven by:

- Falling production costs through technological innovation.

- Increased consumer awareness of sustainability issues.

- Wider acceptance among luxury brands and bridal markets.

The expansion isn’t limited to jewellery. Lab-grown diamonds are increasingly used in electronics, quantum computing, and high-precision engineering, creating multiple demand streams.

Potential Risks to Consider

Like any investment, lab-grown diamonds come with considerations:

- Price normalization: As production scales, prices may stabilize or even decline.

- Brand dependency: Resale value can be influenced by the reputation of the original retailer.

- Market education: While awareness is growing, some consumers still hold misconceptions about lab-grown stones.

The Investor’s Takeaway

Lab-grown diamonds are more than a passing trend—they represent a fundamental shift in how we value luxury. By aligning with the pillars of ethical sourcing, environmental responsibility, and transparent pricing, they’re creating new opportunities for investors who want both returns and impact.

At EcoFacets, we’re not just selling jewellery. We’re offering a model of responsible wealth—where beauty, value, and sustainability coexist.

For the modern investor, that’s not just appealing—it’s essential.